Ever Googled onnilaina and felt like you’d opened three tabs… and still didn’t get a straight answer? Same here. The first time I came across onnilaina, I expected a clear-cut company or app. Instead, I found a mix of meanings, use cases, and interpretations that made me pause and think, Okay, this is more interesting than I expected.

Let’s unpack onnilaina together slowly, clearly, and without the usual finance-world headache. No stiff language. No sales pitch. Just a real, human conversation about what onnilaina is, why people search for it, and how it fits into modern digital lending.

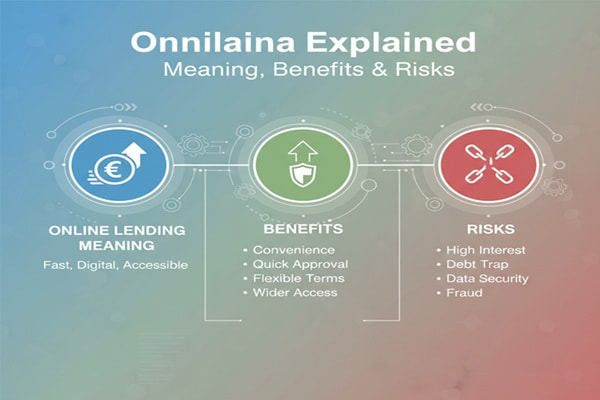

What Is Onnilaina? A Simple Explanation

At its heart, onnilaina connects to the idea of online lending done in a simpler, more transparent way. The term itself often links back to Nordic language roots, where it loosely combines ideas of good fortune and borrowing. That already tells you something about the philosophy behind it.

In practice, onnilaina doesn’t always point to one single global company. Instead, it shows up as:

-

A digital lending concept

-

A loan comparison or referral model

-

A branding term used in fintech content

-

A general keyword tied to online borrowing

Think of onnilaina less as a logo and more as a framework.

Why Is Onnilaina Gaining Attention?

Here’s a real question: When was the last time borrowing money felt simple?

Exactly.

Traditional loans involve paperwork, long waits, confusing interest terms, and more fine print than anyone enjoys reading. Onnilaina steps into that frustration and says, “Let’s clean this up.”

People search for onnilaina because they want:

-

Faster access to loans

-

Clear terms without hidden surprises

-

Online-first convenience

-

Better comparison options

IMO, the appeal feels obvious once you look past the name.

Onnilaina and the Shift Toward Digital Lending

Digital lending didn’t appear overnight, but its growth exploded once people demanded speed and clarity.

Onnilaina fits neatly into this shift by focusing on:

-

Online applications

-

Quick eligibility checks

-

Multiple lender comparisons

-

Minimal paperwork

Instead of visiting banks or calling brokers, users interact with platforms built around efficiency.

And yes, that efficiency matters globally.

How Onnilaina Works in Real Life

Let’s make this practical.

A typical onnilaina-style experience looks like this:

-

You fill out a single online form

-

The system checks basic financial details

-

You see multiple loan options

-

You choose what fits your needs

-

Funds arrive faster than traditional methods

No mystery. No endless back-and-forth.

That structure explains why the concept resonates in regions where digital finance adoption grows rapidly.

Is Onnilaina a Lender or a Connector?

Here’s where people often get confused.

Most onnilaina platforms act as connectors, not direct lenders. They link borrowers with potential lenders rather than lending money themselves.

That distinction matters because it affects:

-

Interest rates

-

Approval responsibility

-

Risk ownership

Knowing this helps users set realistic expectations instead of assuming onnilaina equals guaranteed approval.

Key Features Commonly Linked to Onnilaina

While implementations vary, most onnilaina-related platforms share a few traits.

Core Features

-

One application, multiple offers

-

Transparent rate displays

-

Digital-first user journey

-

Faster decisions

User-Friendly Extras

-

Clear repayment schedules

-

Educational loan guidance

-

Eligibility estimators

Not flashy. Just functional. And honestly, that’s refreshing 🙂

Who Typically Uses Onnilaina?

Onnilaina appeals to a surprisingly wide audience.

You’ll often see it used by:

-

Individuals seeking short-term personal loans

-

People comparing interest rates quickly

-

Borrowers avoiding traditional banks

-

Digital-native users comfortable online

This isn’t limited to one country or income group. The need for flexible borrowing spans borders.

Global Relevance of Onnilaina

One reason onnilaina performs well in search results lies in its global neutrality.

It doesn’t tie itself to one financial system. Instead, it adapts to:

-

European digital lending models

-

UK-style comparison platforms

-

Emerging fintech markets in India

-

Online-first borrowing trends in Australia

-

Convenience-driven users in the USA

That adaptability keeps it relevant across regions.

Onnilaina vs Traditional Loans

Let’s compare without sugarcoating anything.

Traditional Loans

-

Slower approval

-

In-person visits

-

Heavy documentation

-

Fixed options

Onnilaina-Style Digital Loans

-

Faster decisions

-

Fully online

-

Fewer documents

-

Multiple offers

Traditional loans still have their place, especially for large sums. But for speed and clarity, digital models often win.

Benefits of Using Onnilaina Platforms

People don’t just stumble onto onnilaina for fun. The benefits drive interest.

Top Advantages

-

Saves time

-

Improves transparency

-

Increases choice

-

Reduces confusion

From personal experience, even comparing options feels less stressful when everything sits in one place.

Potential Risks You Should Know About

Now for the honest part. Digital lending isn’t magic.

Possible Risks

-

Higher interest for short-term loans

-

Overborrowing due to convenience

-

Misunderstanding repayment terms

Onnilaina platforms simplify access, but users still need to borrow responsibly. Convenience doesn’t replace financial planning.

Responsible Use of Onnilaina

Borrowing responsibly matters more than the platform you choose.

Smart onnilaina use means:

-

Borrowing only what you need

-

Checking total repayment amounts

-

Understanding interest structures

-

Planning repayment before accepting funds

Quick access should never mean rushed decisions.

Onnilaina and Transparency

Transparency sits at the center of the onnilaina idea.

Most platforms highlight:

-

Interest rates upfront

-

Clear repayment timelines

-

Lender identities

-

Eligibility requirements

That openness builds trust, especially among users tired of hidden fees.

Is Onnilaina Safe?

Safety depends less on the name and more on the platform behind it.

In general:

-

Onnilaina-related sites focus on secure applications

-

Data encryption plays a standard role

-

Regulatory compliance varies by region

Users should always verify the platform’s legitimacy before sharing sensitive information.

Why the Name Onnilaina Matters

Names shape perception. Onnilaina combines positivity with practicality.

The tone suggests:

-

Optimism

-

Simplicity

-

Accessibility

That emotional layer helps people feel less intimidated by borrowing, which traditionally carries stress.

Onnilaina in the Broader Fintech Landscape

Fintech keeps pushing boundaries, and onnilaina fits right in.

It aligns with trends like:

-

Embedded finance

-

AI-driven loan matching

-

Mobile-first applications

-

Financial inclusion efforts

As fintech grows, expect onnilaina-style models to evolve further.

Also Read : Insetprag Explained: Meaning, Benefits, Uses & Real-Life Impact

Beginner to Expert: Understanding Onnilaina Fully

Beginner View

“Onnilaina helps people find online loans.”

Intermediate View

“Onnilaina connects borrowers with lenders through digital platforms.”

Advanced View

“Onnilaina represents a user-centric, transparent digital lending framework optimized for speed and comparison.”

Same concept. Deeper understanding.

Common Misunderstandings About Onnilaina

Let’s clear the air.

-

Onnilaina doesn’t guarantee approval

-

Onnilaina isn’t always a direct lender

-

Onnilaina doesn’t remove repayment responsibility

Once you understand that, everything else makes sense.

FAQ: Onnilaina Explained Clearly

What does onnilaina mean?

Onnilaina generally refers to a digital lending concept focused on accessible and transparent online borrowing.

Is onnilaina a real company?

In many cases, onnilaina functions as a concept or platform name rather than a single global company.

Does onnilaina offer loans directly?

Most onnilaina platforms connect borrowers with lenders instead of lending money themselves.

Is onnilaina safe to use?

Safety depends on the specific platform. Always check security, reviews, and regulatory details.

Why is onnilaina popular online?

People value speed, transparency, and convenience when borrowing money.

Can onnilaina help with bad credit?

Some platforms offer broader eligibility, but approval still depends on lender criteria.

Is onnilaina suitable for long-term loans?

It usually works better for short- to mid-term borrowing rather than large, long-term financing.

Final Thoughts on Onnilaina

Onnilaina doesn’t reinvent money. It rethinks access.

By simplifying how people explore loans, compare options, and understand terms, onnilaina reflects a shift toward smarter, more human-centered finance. It removes friction, but it doesn’t remove responsibility and that balance matters.

If you’re exploring digital lending, take your time, read the details, and treat onnilaina as a tool, not a shortcut.